Bank of England cuts rate to 3.75% for households and businesses

On 18 December 2025, the Bank of England reduced its main interest rate from 4% to 3.75%. This is the lowest level in nearly three years. The

On 18 December 2025, the Bank of England reduced its main interest rate from 4% to 3.75%. This is the lowest level in nearly three years. The

The Chancellor, Rachel Reeves, has delivered the first Autumn Budget of this Parliament. She called it “a decade of national renewal.” This Budget brings real, immediate

The Bank of England (BoE) issued a sharp warning on 8 October 2025, cautioning that certain AI and technology stocks may be overvalued, particularly those

The Bank of England and HM Treasury began formally considering a national digital currency in 2021, launching a joint taskforce to explore what’s now called

Chancellor Rachel Reeves has confirmed the Autumn Budget will take place on 26 November 2025. As with the Spring Statement earlier this year, this annual

The UK economy may look like it’s picking up speed. In the second quarter, GDP rose by 0.3%, a sign that things are moving in

HMRC recently updated their Transformation Roadmap to making the UK’s entire tax systems entirely digital by 2030. By 2028, HMRC expects 90% of tax interactions

Legend Financial is delighted to announce our new partnership with Portman Finance Group. This collaboration marks an exciting step forward. Access to the right financial

From 18 November 2025, identity verification will be mandatory with Companies House, and failure to comply may lead to a criminal offence. Over 6 million

HM Revenue & Customs (HMRC) has launched a new enforcement campaign aimed directly at company directors. If you are a director who had a loan

The amount of tax on rental income you pay depends largely on your taxable income, the profit you earn from letting out a rental property,

Do you have a side hustle going online? Maybe you are selling some amazing crafts on Etsy, renting out rooms on Airbnb, or perhaps earning

Contents Working for yourself comes with many rewards, but understanding your tax obligations is also paramount. Unlike employees who have tax deducted automatically through PAYE,

When buying a property in the UK, stamp duty is a crucial consideration as it can add thousands to the purchase price.

The days of crypto anonymity are coming to an end. From January 2026, HMRC will begin receiving automatic data on UK taxpayers’ cryptoasset activities from

The removal of P11D forms, replaced by mandatory payrolling of benefits in kind (BIK) by April 2026, is deferred for 12 months. This was first

From 6 April 2025, changes to company car tax came into effect. These new rates can affect how much Benefit-in-Kind (BIK) tax you pay. These

Stamp duty land tax SDLT is the tax imposed on buyers for the properties or pieces of land they bought in England or Northern Ireland.

Contents Property purchases in the UK must be paid stamp duty by the buyer. In England and Northern Ireland, it is called Stamp Duty Land

HMRC is currently writing to people that have been impacted by an old administrative error. This error was related to Home Responsibilities Protection (HRP). If

The Construction Industry Scheme (CIS) is a tax deduction system that applies to most construction workers in the UK.

Contents Being self-employed in the UK comes with a mix of challenges and opportunities. On one hand, individuals gain invaluable flexibility and autonomy, setting their

Chancellor Reeves delivered her Spring Statement speech on 26 March 2025, and contrary to the historical two Budgets per year, there will now be one

Contents VAT fraud is the most common form of tax evasion worldwide. In the UK alone, authorities estimate that VAT fraud costs the treasury billions

Alongside tax hikes, the UK government also provided significant tax reliefs and allowances every year, which both employed and self-employed people can benefit from.

On 1 April 2013, the Annual Tax on Enveloped Dwellings (ATED) was implemented wherein Non-Natural Persons (NNPs) who have more than £500,000 worth of interest

Contents Businesses in a tight financial situation may qualify for Entrepreneurs’ Relief, which can help them substantially save on their CGT when disposing of all

![What is Council Tax? [2025 Guide]](https://legendfinancial.co.uk/wp-content/uploads/2023/09/LF-Blog-33-CR250210LF-ft-1-768x463.webp)

Contents Whether you are a first-time homeowner or a long-term renter, chances are you have heard of the phrase ‘council tax’. But what is council

![Tips on How to Reduce Tax on Rental Income [2025 Latest]](https://legendfinancial.co.uk/wp-content/uploads/2025/09/LF-Blog-30-CR250303LF-ft-1-768x463.webp)

As a landlord, you must know that rental income is subject to income tax. However, you might be paying more tax than necessary, probably due

Chancellor Rachel Reeves has made it clear: tax evasion will be dealt with swiftly and strictly this year. HMRC is teaming up with Companies House

As a business owner, you must be familiar with the intricacies of Value Added Tax (VAT).

From 1 April, the National Minimum Wage saw another set of increases. These are the changes from the last year

From 1 April 2025, stamp duty thresholds have reverted to their original levels after the temporary (almost) three-year threshold increase.

More than fifty per cent of self-employed individuals register as sole traders in the UK, and the number keeps increasing.

Having a hard time managing finances for your online business? This article serves as a guide to simplify the ecommerce bookkeeping process, highlighting its benefits

At the heart of every business’ financial stability lies one crucial element, i.e “cash flow”. It is the lifeblood of any successful enterprise that keeps

Contents HMRC’s tax investigations can be expensive, complex, and time-consuming. Even individuals and businesses with a good accounting team feel like they are caught off-guard

Contents If you miss your corporation tax payment deadlines, HMRC will charge interest on the outstanding amount. This interest keeps on accumulating the longer the

![Corporation Tax on Losses: Reduce Your Tax Burden [2025]](https://legendfinancial.co.uk/wp-content/uploads/2025/02/LF-Blog-20-Corporation-Tax-on-Losses-ft-768x463.webp)

Contents Every business encounters losses at some point, but how you tackle them makes all the difference. HMRC offers UK companies relief on corporation tax

Contents If you are part of the Construction Industry Scheme (CIS), you might be due a CIS repayment from HMRC. This article will walk you

Contents There are over 30 million e-Commerce websites now up and running. If you are ready for a business open all round the clock, setting

Contents If you are a company that makes and owns its inventions and holds a patent granting exclusive rights to your intellectual property, you will

Contents Cryptocurrency has rapidly evolved into a global phenomenon, reshaping the future of finances. As more and more people adopt crypto for investment, trading, and

Contents The Construction Industry Scheme (CIS) was originally designed to prevent tax evasion among construction workers. To enforce compliance, CIS penalties were implemented. Ensuring you

Contents Taxation on capital gains started in 1965 in the UK, with rules changing dynamically over the years. Like it or not, you pay this

Contents Tax relief on charity donations in the UK is a way to encourage people to support charitable organizations whilst also saving on their taxes.

Contents When you are a middle-class earner, finding ways to save on taxes can make a big difference in your finances. It is easy to

Contents The bank reconciliation statement is an important document that compares an organisation’s financial records with its bank statement. The purpose of this document is

Contents The UK income tax calculator is available in various versions according to the taxpayers’ employment status—employed, self employed, or a combination of both. For

Contents Any income earned in the UK is taxed, and that does not exempt you when your usual abode is outside the UK, or you

Contents Gift Aid is a government initiative that allows UK taxpayers to increase the value of their donations to charities at no extra cost to

Contents IR35 rules sift out the employed from the genuinely self-employed for tax purposes. It became a law in April 2000 but was only taken

Contents With the growth of the gig economy, an increasing number of people are balancing full-time employment with part time side hustles. This guide will

Contents Most supplies and services are charged the standard VAT rate (20%). If you work in the construction sector, your client may qualify for VAT

Contents Is a redundancy payment tax free? Whether you are made redundant by your employer or volunteered for it, this guide will give you clarity,

Contents Learn about the tax threshold 2024 UK in this guide, from your primary taxes to others you may deal with at some point. We

Contents Generally, mortgage lenders assess borrowers’ loan potential through 2 to 3 years’ worth of income proof. Requirements may be less when you work under

Contents When it comes to paying taxes, many hardworking Britons feel they are bearing the brunt, whilst the wealthiest seem to play by different rules.

Contents Knowing when you start becoming liable to tax is crucial, especially if you are self-employed where self assessment is mandatory upon hitting the income

Contents Private schools are no longer exempt from VAT starting January 2025, confirmed in the recent Autumn Budget. This article covers all you need to

Chancellor Rachel Reeves delivered her first Budget on 30 October 2024 aimed at “national renewal.” The Budget offers some relief to low-income workers, whilst businesses

Contents EORI stands for Economic Operators Registration and Identification. Put simply, you need this number to ship internationally, specifically in or out of the European

Contents Second homes are taxed depending on whether you bought, sold, rent out for profits, and other factors. When do you pay tax on second

Contents If you’re one of the departing employees made ‘redundant’ by your employer, you may be entitled to redundancy pay. One of the most popular

On 29 July 2024, the UK government announced a draft legislation on removing private school’s VAT exemption status, alongside business rates, effective in January 2025.

Contents With the rising cost of living in the UK, taking second jobs may be a necessity for some to make ends meet. If you

Contents If your tax affairs become too complex for you to handle, they may be best left to experts. How to find tax advisor may

Contents Under the Pay as You Earn (PAYE) system, employee pay is taxed at source. But what happens when your payslip shows no tax deductions?

Contents If you are new to self-employment, you need to inform HMRC first thing so that you get taxed accordingly. Below, we cover how to

Contents Tax is a major consideration if you want to keep more of your hard-earned wealth. This is efficiently done with tax planning. Tax saving

Contents Even if there is no tax to pay, a filing deadline missed will automatically mean a late tax return penalty. If you are due

Contents Do you pay corporation tax on dividends? Limited companies often wonder if they pay corporation tax on their dividend payouts. How UK dividend taxation

Capital Gains Tax Rules on Overseas Property [Latest Updates] Capital Gains Tax Rules on Overseas Property [Latest Updates] Capital Gains Tax Rules on Overseas Property

Contents Are you struggling with your corporation tax payment? You’re not alone. Many UK businesses face challenges when it comes to managing their tax obligations,

Contents Do you have to pay capital gains when you sell your house? The answer depends on the taxpayer’s situation, such as whether they own

The Labour Party officially won in Parliament on the last 4 July 2024 general election. It was a majority win, ending the Conservative Party’s 14-year

Contents HMRC may be efficient in managing taxes, but mistakes can still happen, and frequently. Miscalculations usually result in overpaid taxes, but these are repaid

The identity verification requirement placed on new and existing directors and people with significant control (PSCs) was introduced under the Economic Crime and Corporate Transparency

Contents Tax codes represent how much tax to deduct from an employee’s paycheck. They are alphanumeric, with L being the most common (1257L for the

Contents UK business rates are charged on most non-domestic or commercial properties. This differs from council tax, which is charged on domestic properties. Both property

Contents To promote small business growth, the UK government introduced the Seed Enterprise Investment Scheme (SEIS), which offers massive tax breaks for investors. Moreover, if

Contents The UK government recognises both—the vital role successful startups play in driving jobs, innovation, and economic growth and the risky nature of investing in

Contents Getting a Unique Taxpayer Reference (UTR) number is essential to anyone who needs to file self-assessment tax returns in the UK. Whilst the number

Contents UK business owners must understand all their statutory requirements to remain legally compliant. One of them is the confirmation statement UK, which must be

Contents How much can you earn before paying tax UK? Find out the answers here, as we offer a straightforward approach to taxation in the

Contents The National Living Wage 2024/25 decreased its age threshold from 23 to 21, which was in place since 2016. This significant change brings not

Contents Self-assessment is simply HMRC’s way of getting taxpayers to report their income and pay taxes. The process of registering for and completing this tax

Contents Understanding the list of tax codes and what they mean can be very challenging for small businesses. In many cases, the responsibility usually falls

Contents Normally, VAT registration threshold applies, but not in the case of traders without UK establishments, who, for VAT purposes, are termed non established taxable

Since 3 June 2024, HMRC launched another one-to-many (OTM) letter campaign, this time specifically aimed at businesses suspected of using till systems to hide or

Contents Currently, a business must register for value-added-tax (VAT) when their total annual turnover reaches the £90,000 VAT threshold, or if they anticipate earning so.

Contents Both contractors and subcontractors working in the construction sector are subject to Construction Industry Scheme CIS, which means they register under the scheme and

Contents Employers often incur extra costs outside salary payments, usually non-cash rewards for employees, which are taxable benefits in kind (BIK). Some of these expenses

Contents Whether to charge VAT on consultancy services or not will be answered in this article. Read on for a brief guide to this indirect tax,

Contents Tax relief working from home reduces a portion of the financial burden incurred for job or business purposes. This works by reducing the taxable income

Contents Understanding the role of personal tax allowance in an individual income tax gives a clearer grasp of how much the taxpayers’ take-home pay and

Contents Do I pay tax if I sell my house? Many homeowners in the UK wonder about this when they decide to sell their homes

HMRC is updating late payment penalty rules to prevent tax avoidance. Currently, HMRC can assess a second penalty when the full amount of outstanding tax

Contents Business Asset Disposal Relief (BADR), previously known as Entrepreneurs’ Relief, offers significant capital gains tax relief for business owners when disposing of qualifying assets,

Contents Corporation tax rates UK had been following a single flat rate system for all businesses regardless of size up until April 2023. There are

Contents At every point of property ownership, landlords have several tax obligations—when they bought the property, rent out for profits, and sell. Below is a

Contents Pay-as-You-Earn (PAYE) workers need the P45 form when they start their first job or leave an old role for another. The form basically passes

Contents Not all accounting practices are solely for government compliance, such as management accounts. Unlike statutory accounts, they are optional and tailored to specific business

Contents Late payment of corporation tax and other taxes attract additional interest. Starting August 2023, the late payment interest rate rose to 7.75%. HMRC, on the

Contents Double taxation treaties clarify cross-border taxation systems and primarily exist to prevent an individual from being taxed twice in two states and mitigate tax

Contents With the personal allowance and additional rate thresholds staying frozen until 2028, the Institute for Fiscal Studies (IFS) forecasts that approximately 2.1 million more taxpayers

Contents Are financial advisor fees tax deductible in UK? This and other self-employed expenses are discussed in this article, covering which expenditures are tax deductible

Contents Since April 2022, the UK income tax rates 2024/25 threshold has stayed frozen, with the next increase expected in April 2028. Read on for

Contents Running a small business involves juggling several tasks at once, which makes it especially easy for small startups to overlook their financial health. Hiring

Contents Marriage allowance offers married or civil partners tax savings of up to £252 for the 2024/25 tax year. This article provides a comprehensive introduction

Contents VAT-registered businesses pay input VAT on their purchased goods and services, which they can reclaim afterwards. Normally, they claim a VAT refund on their

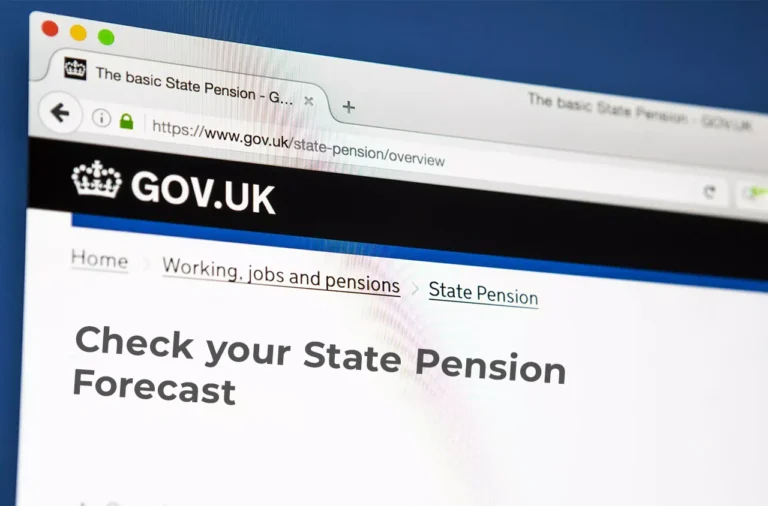

The government recently launched a new digital service called Check Your State Pension forecast, a joint service between the Department for Work and Pensions (DWP)

The non-dom tax status regime is set to be abolished by 6 April 2025, surprising many wealthy non-domiciled people with the speedy implementation. More commonly

Contents HM Revenue and Customs implemented the Construction Industry Scheme (CIS) to make paying taxes fair for both employed and self-employed individuals, ensuring that the

Contents The Autumn Statement 2023 announced an increase in the UK minimum wage 2024 for all four wage categories. Changes in minimum pay always begin in April,

Contents Since pension income is considered an ordinary income, it is taxed. The rule of thumb is to withdraw only within the annual income tax

On 22 April, HMRC will initiate the pilot phase of Making Tax Digital (MTD) for income tax self-assessment. Craig Ogilvie, Director of MTD, has reached

Contents The latest HMRC Digital Disclosure Service (DDS) is accessible to everyone who wants to straighten their tax affairs. This is to encourage all taxpayers

Contents Capital allowances on property come in several types, each with dynamic and intricate rules. These allowances are not automatic and must always be claimed

Starting from Spring 2024 in May, taxpayers accessing HMRC’s online services for the first time will need to create a GOV.UK One Login account instead

Contents How much taxes a subcontractor pays depends on whether they are CIS and/or VAT registered. Our CIS calculator for tax deductions and rebates will

Contents HMRC automatically class UK people who lived abroad for more than six months in a year as non-resident landlords, even if they are considered

Contents HMRC incentivises early payment by paying companies a 0.5 per cent interest rate on their total company tax bill. To take advantage of this

Last 6 March 2024, the chancellor announced the details of the latest Spring Budget. Here are how the Budget announcements could affect different aspects of

Contents Inheritance tax applies to the taxable portion of the estate and is charged at a standard 40%. With the right IHT planning, gifting millions

Contents Capital gains taxes are paid on profits generated from asset sales or transfers in the UK once the annual allowance is exceeded. Rates depend

Chancellor Jeremy Hunt has presented the details for the Spring Budget in the House of Commons, the last scheduled before the anticipated general election later

Contents Stamp duty tax rates vary in England and Northern Ireland, Scotland, and Wales. This article focuses on UK stamp duty rates for non-residential properties,

Despite the Institute for Fiscal Studies’ warnings against tax cuts without clear funding sources and the increasing economic pressure on the government, Chancellor Jeremy Hunt

HMRC is currently scrutinising companies’ claims on annual investment allowance (AIA), which is subject to an annual limit of £1,000,000 from 2019. AIA is a

HMRC issues another one-to-many letters to corporations and individuals; this time, on unreported shares disposal income for capital gain tax purposes (CGT). The letter outlines

Beginning 4 February 2024, HMRC has been distributing one-to-many letters specifically targeted at suspected company directors, prompting them to disclose their potentially unreported dividend profits.

Seeing more ‘headroom’ to wiggle for tax cuts, Chancellor Jeremy Hunt is set on giving ‘crowd-pleasing measures’ before the general election, which may potentially allot

Beginning January 2024, HMRC is stringently clamping down taxes on side hustle incomes to prevent tax evasion through the new data-sharing rules. The new tax

Chancellor Jeremy Hunt hopes to implement further tax cuts before this year’s general election believing it is the shortcut way to enhance the UK economy, which may

People who earn income from ‘side hustles’ will be taxed beginning January 2024. The UK signed up to the Organisation for Economic Cooperation and Development’s

Contents HMRC sends one to many letters to different taxpayer groups or agents for various purposes, with content ranging from pure information to prompts. UK

Let Property Campaign Accountant near me HMRC had been clawing back billions from many unreported rental incomes through the Let Property Campaign. If you earn

Last 6 January, the 2p Class 1 National Insurance (NI) tax cut took effect, benefiting 27 million taxpayers in the UK, as announced in the

HMRC sends one to many letters to different taxpayer groups or agents for various purposes, with content ranging from pure information to prompts. UK landlords

A lot of tax changes are to take effect this year, calling for major tax planning and preparation for both individuals and businesses. Businesses most

The UK government announced last week Monday that Carbon Border Adjustment Mechanism (CBAM) will be officially implemented in 2027, which will include aluminium, cement, ceramics,

Contents Scotland’s deputy first minister and finance secretary Shona Robison announced on Tuesday the Scottish Budget Statement at Holyrood, which highlighted the new advanced rate

Contents HMRC’s tax avoidance suspicions toward huge multinational companies will be recurring, as long as lack of tax treatment transparency remains. TaxWatch’s latest scrutiny shows

Contents Interior Minister James Cleverly announced on Monday new measures for immigrants, which is to take effect from next year’s Spring Statement, aimed at cutting

Contents Setting up pension pots is one of the most tax-efficient ways to earn a steady retirement income. State pension savings, for example, can be

Contents The Pay as You Earn (PAYE) and Construction Industry Scheme CIS systems deal with taxes in a parallel manner. Employees pay taxes through PAYE,

Contents When it comes to investing, tax efficiency is everything given that tax fees largely affect how much profits investors will get when the investment

Contents Setting up a pension scheme is one of the quickest ways to get tax relief on your annual income. The annual allowance tax relief

On 22 November 2023, Chancellor of Exchequer Jeremy Hunt announced the Autumn Statement for the year, alongside the Office for Budget Responsibility’s (OBR) economic forecasts.

Contents Familiarising tax legislation relevant to their business is certainly a must for eCommerce suppliers. One kind of tax both physical and e-retailers need to

Contents In the last two years, shopping through the internet has undoubtedly become the most preferred form of purchase amongst customers in the UK, just

Contents With all the hats you wear when running your business, it’s normal for your finances to occasionally fall by the wayside, but no one

Contents Bookkeeping tasks are essential for successful day-to-day operations of any ecommerce business. It deals with everyday transactions such as recording, stockpiling, recovery of bookkeeping

Contents Ecommerce accounting services are not just all about bookkeeping and tax advice but also making strategies for business growth. Numerous ecommerce sellers handle their

Contents The bounce back loan scheme (BBLS) was a government lending support initiative for businesses struggling financially at the height of the pandemic. For the

Contents Now that the Bounce Back Loan Scheme and repayments are due, the Pay as You Grow scheme comes to the rescue. Implemented as a

Contents In the UK, there are currently 50 per cent of self-employed individuals running their sole trader business, enjoying the freedom and autonomy that sole

CIS invoice templates ensure that construction workers comply with the Construction Industry Scheme tax requirements in their invoicing. This article tackles all about CIS invoice

Contents Approximately 30 per cent of landlords in the UK found themselves pursuing the letting business not by plan but by circumstance. These people are

Contents Given the government’s quick need to provide wage support measures for the employer, trade union on a collective agreement, and furloughed employee impacted by the

The decline in payroll figures showed an increasing unemployment rate to 3.9% for the first time in two years. There are clear indications of reduced

Recent data from Rightmove shows that new first-time buyers in the UK are paying nearly £200 more per month on their mortgages than they did

Contents Have you earned income from investments, received savings interest, or collected dividends? These are all interconnected ways your money can grow. But did you

Amidst the current cost of living crisis, Britain’s largest supermarkets are facing calls for an investigation by the UK’s competition watchdog over claims of profiteering.

Before the upcoming general election, Prime Minister Rishi Sunak is considering lowering the country’s inheritance tax, citing people familiar with the situation. Sunak was enthusiastic

The government has altered charitable relief regulations to support the UK’s philanthropic sector. This legislation changes particular goals, the new limitations and specifications for charities

Employers must submit and modify forms P11D and P11D (b) online, except for those digitally excluded. Forms P11D and P11D (b) on original or amended

The UK government is projected to present significant tax relief to its petrol and oil industries in the coming week. Rishi Sunak, the prime minister,

On 15 March 2023, the Chancellor of the Exchequer created the Budget with assistance from his department, the Treasury, and told the MPs that the

A business that charged people a considerable amount to file claims for tax refunds without further transparency has been shut down. Once HMRC determined that

The government revealed the new National Living Wage (NLW) rates that will be in effect starting in April 2023. The NLW will now be at

The UK’s economic picture has become worrisome as the budget deadline draws nearer daily. Nevertheless, a glimmer of hope has been provided, which might allay

On Thursday, 9 February, senior council members at Stafford Borough Council suggested amendments to the Local Council Tax Reduction (LCTR) programme, which would result in

Electric cars are a more environmentally beneficial option than using a diesel or gasoline engine. Working individuals can take part in this by reducing their

As part of a £600 million support package to assist Britain’s two largest steelmakers, British Steel and Tata Steel, in investing in greener technologies and

Intending to ensure that the programme is modernised, affordable, and in better compliance, the government announced proposed legislation in July 2022 addressing significant modification to

Deputy First Minister John Swinney spoke about the government’s tax and spending proposals, focusing on the NHS and social security. Despite households battling a cost

According to new research, UK grocers and supermarkets will receive a tax break worth about £550 million over the next three years. It comes after

Significant progress in bilateral trade between the UK and Brazil occurred on November 29, 2022, when they signed a Double Taxation Agreement (DTA). Due to

On the Autumn Statement 2022, Chancellor Jeremy Hunt announced that an increase of up to 6 per cent in the corporation tax rate for companies

The van benefit and fuel benefit data for automobiles is one of the important news for mid-December 2022. From 6 April 2023, the van fuel

Based on recent data from the trade association British Retail Consortium, meat, eggs, and milk prices increased to new records in November, a “bleak” winter

The government provides an expanded programme to insulate Britain’s draughtiest homes, helping households potentially save up to £310 per year. Beginning in the spring of

With the transition to Making Tax Digital (MTD) and the need for VAT-registered firms to file VAT returns using MTD-compliant software starting in November 2022,

Beginning in November 2022, two batches of nudge letters will be distributed. These are meant to urge recipients to disclose any identified unpaid UK tax

When announcing the UK government’s spending plans, Chancellor of the Exchequer Jeremy Hunt is considering obtaining extra revenue from inheritance tax to plug a £35

Sole traders, landlords, and other businesses earning from multiple resources or on ordinary partnerships that earn more than £10,000 annually have already been required from

Following chaotic few days after Liz Truss’ resignation, Rishi Sunak is to become the new prime minister of the United Kingdom.

The surprising moves by new finance chief Jeremy Hunt, parachuted into the job on Friday to replace sacked Kwasi Kwarteng, leaves Truss’ position in a

The central bank is gradually raising interest rates as Britain undergoes significant change, including a new government and monarch, to prevent high inflation from spreading

The financial crisis brought on by the mini-budget, which prompted the Bank of England (BOE) to seek a £65 billion emergency bailout, was centred on

Chancellor Kwasi Kwarteng announced last 23 September his mini-budget or “Growth Plan,” which is considered to have implemented the biggest tax cuts in a generation.

The UK government borrowed £11.8bn in August in preparation for helping the public with the soaring costs of living, which is almost twice as much

The new Prime Minister Liz Truss tackles severe economic headwinds with bold measures for the skyrocketing energy bills. Hours before the Queen’s death, she announced

After a summer-long internal campaign triggered by Boris Johnson’s resignation in July, Liz Truss defeated her competitor, former finance minister Rishi Sunak, by 81,326 votes to

Beginning on 4 April 2022, effective in Wales and England, the government requires tax checks on individuals, business partners, or those who operate through company

Rishi Sunak showed concerns regarding the pressure and living standards in the light of tax scenarios as he stated that cutting taxes now without balancing

Contents Current events such as the global pandemic and uncertain economy can be a few of the most significant factors for businesses to spiral down

The government has released a draft tax legislation before its potential inclusion in the Finance Bill 2022–2023 to allow for technical consultation. The upcoming Finance

The UK government announced last February three different schemes of energy support to aid energy consumers in the present crises in which the energy suppliers

The G7 countries, with the most advanced economies, are nevertheless affected by the current global economic issues just as the rest of the world, with

Contents A business’ growth entails the need for proactive means of handling finances. Laying the math on a spreadsheet or paper will only prove to

Contents The financial aspect of a business isn’t just about computing sales. Like it or not, it also encompasses taxes and many other areas, which

To help with the cost of living crisis, the British prime minister Boris Johnson and chancellor Rishi Sunak announced the single biggest tax cuts of

For the fifth time in a row, the Bank of England (BoE) announced another hike in interest base rate by a quarter-point, now totaling to

Contents The number of eCommerce businesses launching in the UK is increasing for various reasons. Putting a business online allows it to reach an even

The UK is currently seeing its worst cost of living crisis for decades, with inflation at a 40-year high and wages decreasing. The Chancellor reported

Contents Accounting is a seriously intricate undertaking, and you want experts to manage it. Your business will possibly prosper when every one of the financial

To tackle the rising energy costs that skyrocketed the price of living in the UK, the government has announced on the third of February a

Due to the high increase in global oil and gas prices, the inflation rate in the UK is running at 9%. The public authority has

Contents In 1908 the initial state pension was presented to the United Kingdom. Social Government’s monetary help brought this concept, and it is ongoing till

According to the Office for National Statistics, the United Kingdom’s consumer increase in price reached 7% last month, exceeding economists’ prognostications for the sixth month

Inflation has kept expanding by 8 percent at rates not found in many years since the October 2021 Spending Review. Subsequently, Legend Financial assesses that

Contents E-commerce business is a robust business – cash moves quickly, and measurements change day by day. An e-commerce business can be unusual (irregular deals,

Contents At the point when you’re simply getting your E-Commerce business going, monitoring your funds can be somewhat of a bad dream. In the event

Contents For most people, buying a house is the most significant and proudest purchase of your life. All of the meticulous measures you took—innumerable property

Contents The United Kingdom has a complex and constantly changing tax system. Numerous tax reliefs and provisions are available to reduce tax liabilities legitimately without

Contents The furnished holiday let, also known as an FHL, is referred to in the UK as a rental property. This classification provides certain tax

Contents One of the more convoluted aspects of VAT is the treatment of construction work in the construction industry. The construction VAT rates for new

Contents VAT is often much simpler than it is generally portrayed, but this does not mean it should be taken lightly. The standard method of

Contents Corporation Tax is paid on any taxable profits that your organization has. You’ll have to make good on Corporation tax if you set up

Contents When most items or services are sold, VAT is added to the original deal cost, ordinarily at a pace of 20%. Be that as

Contents Corporation tax is the principal charge that a limited company or enterprise should pay. Corporation tax should be paid both on the company’s profits

Contents A direct tax collected as a source of income from business entities by the government is referred to corporate/corporation tax. Corporation tax is indicted

“The UK government introduced Coronavirus Job Retention Scheme to help the employees during the COVID-19 pandemic.” CJRS implies that an employer should give eighty per

CGT can be an intimidating subject to understand. CGT was first introduced in 1965. Until then capital gains were not subject to tax.

Is there any way for claiming back VAT? Imagine you are paying VAT on different goods and services but you have no awareness about how

All of the items that are either purchased or on sale have a specific amount of tax on them. This tax may be called VAT.

Contents You might have frequently heard this question, “Where do you see yourself in the next five to ten years?” Everyone usually has a long

The Forlough scheme/CJRS will be extended until the end of September. After July, businesses will be asked for a 10% contribution, rising to 20% in

Contents A loved one’s death incurs costs not only for funeral services but also for Inheritance Tax (IHT). The latest survey says that 3.9% of

Our Experts

Fahad is a Chartered Certified Accountant (ACCA), with a motto “When “why” is clear, “how” is easier”. He is proficient in numeracy and impassioned with giving concise advice to a wide range of clients.

Junaid has been instrumental in the achievement of our success across various regions and he specialises in business management, accounting and tax advisory services.

Faizan is good at providing well-thought-out strategies and solutions to complex problems in Business Development which makes him a proficient overseer of our clients.

The quickest way from A to B is usually a conversation. So, if you want to find out more about how Legend Financial can boost your business, get in touch. We’ll give straight answers so you can make a confident decision, fast.

On 18 December 2025, the Bank of England reduced its main interest rate from 4% to 3.75%. This is the lowest level in nearly three years. The

The Chancellor, Rachel Reeves, has delivered the first Autumn Budget of this Parliament. She called it “a decade of national renewal.” This Budget brings real, immediate

The Bank of England (BoE) issued a sharp warning on 8 October 2025, cautioning that certain AI and technology stocks may be overvalued, particularly those

The Bank of England and HM Treasury began formally considering a national digital currency in 2021, launching a joint taskforce to explore what’s now called

LET’S DO BUSINESS

The quickest way from A to B is usually a conversation. So, if you want to find out more about how Legend Financial can boost your business, get in touch. We’ll give straight answers so you can make a confident decision, fast.

[ninja_form id=’38’]