Contents

At the heart of every business’ financial stability lies one crucial element, i.e “cash flow”. It is the lifeblood of any successful enterprise that keeps it afloat and running. Without proper cash flow management, even the most profitable businesses can quickly plunge into financial loss. This comprehensive guide will help you find the best cash flow management software for your business in 2025. Find powerful tools that can transform your financial game.

What Is Cash Flow Management Software?

Cashflow management software helps businesses efficiently keep track of and regulate their cash position. It gives you real-time information for the previous, current, and upcoming cash inflows and outflows. But why is this important?

Benefits of Using a Cash Flow Management Software

- Automates key processes to save time.

- Cloud-based management provides the flexibility to scale your business as required.

- All your financial information is stored in one place, accessible anytime, anywhere.

- Reduces the risk of errors and late payments.

- Manage all your bank accounts in one place.

- Reduces administrative burden on your team.

- Easily detect any anomalies through Ray ID, risk of frauds, and more.

Factors to Consider When Choosing Cash Flow Software

1. Business Fit

- Business Size: Are you a small startup, a growing SME, or a large enterprise? Software solutions are designed for specific business sizes. Choose the one that aligns with yours.

- Specific Needs: Do you require e-commerce integrations, project management tools, or just advanced forecasting capabilities? Prioritise the features that are most critical to your business needs when choosing cash flow management software.

2. Budget & Pricing

- Budget: Before choosing cash flow software, decide how much you’re willing to spend. There are both free and paid options, so find one that fits your financial needs.

- Pricing Models: These software comes with different pricing structures. Some charge a monthly subscription, whilst others require a one-time payment. Consider what works best for your business and whether it has value for money or not.

3. Functionality & Integrations

- Accounting Software Integration: The software needs to align seamlessly with your existing accounting software (like Xero, QuickBooks, or Sage) so that your cash flow management operations continue running smoothly.

- Deployment (Cloud vs. On-Premise): Consider whether you prefer cloud-based software (accessible online) or on-premises solutions (installed on your local servers). Cloud-based options typically offer greater flexibility and accessibility.

4. Usability

- Ease of Use: Choose software with an intuitive interface and user-friendly design. A complex system can reduce efficiency. Look for free trials or demos to test the user experience.

Cash Flow Management Example

A custom furniture business faces delayed payments from clients. They need to cover expenses like materials, wages, and rent. To stay up and running, they use financial projections software to forecast upcoming cash inflows and outflows. By analysing past trends, the software predicts when cash shortages might occur and keeps their business afloat.

Top 9 Cash Flow Management Software in 2025

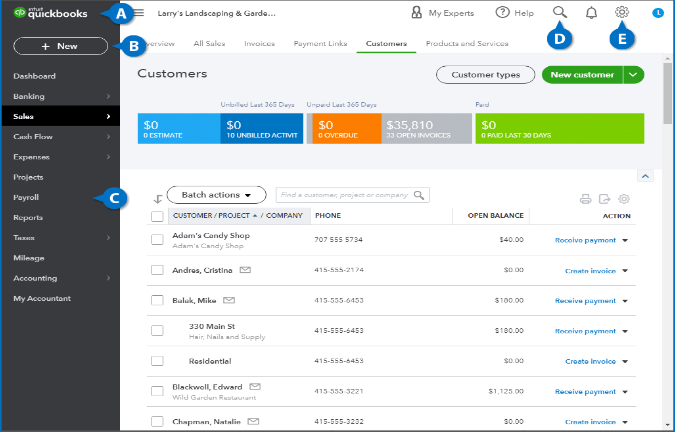

Quickbooks Online

QuickBooks earns the first place on our list, due to its ease of use and familiarity among business owners. QuickBooks offers customisable invoicing, cash forecasting, expense tracking, and reporting. Its user-friendly interface can be operated by beginner accountants and non-experts alike. This makes QuickBooks a go-to choice for small to medium-sized businesses with simpler needs.

Cons:

- Limited advanced features

- Can be costly as business scales

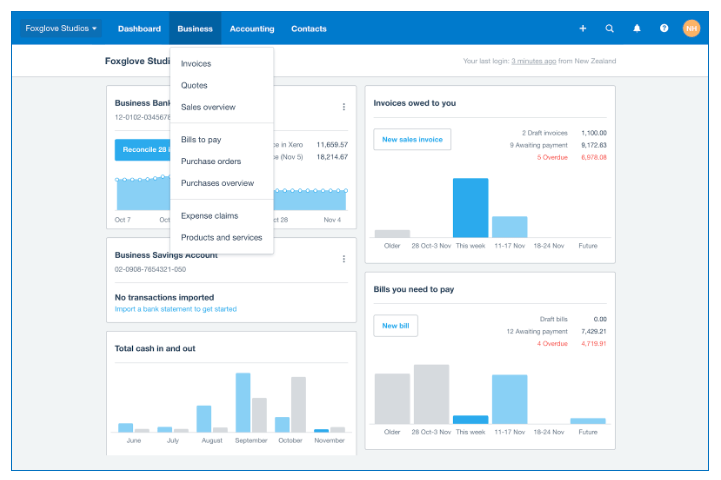

Xero

If you run an online business, Xero is a great option for you. Its collaborative features make it ideal for teams working remotely. Xero’s real-time bank feeds and automated reconciliation simplify cash flow tracking, whilst its built-in forecasting tools provide valuable insights. Using its extensive app marketplace, you can integrate it with other tools to enhance functionality.

Cons:

- Can become expensive with added features

- Limited customisation options

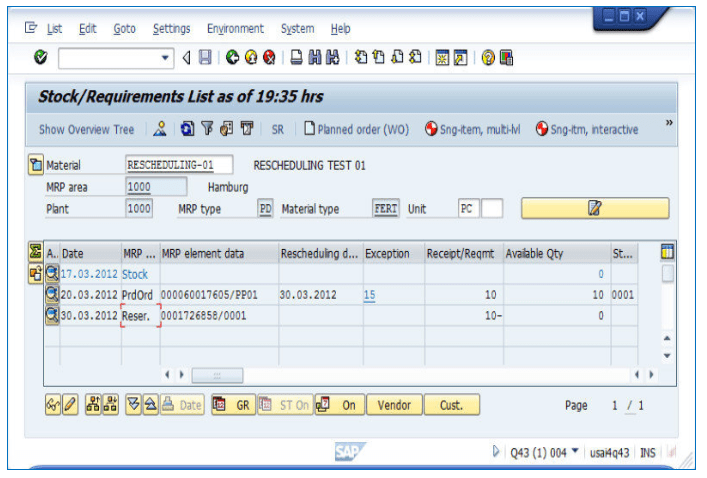

SAP

SAP’s inclusion in our list is due to its position as an industry leading ERP provider. It offers more advanced cash flow management capabilities for larger enterprises. It comes with advanced forecasting tools, financial planning, and treasury management. SAP’s integration with other modules, such as supply chain management and human resources, provides a holistic view of the business. It is powerful and scalable software, capable of solving complex financial tasks.

Cons:

- Difficult to set up

- High cost

- Requires specialised training

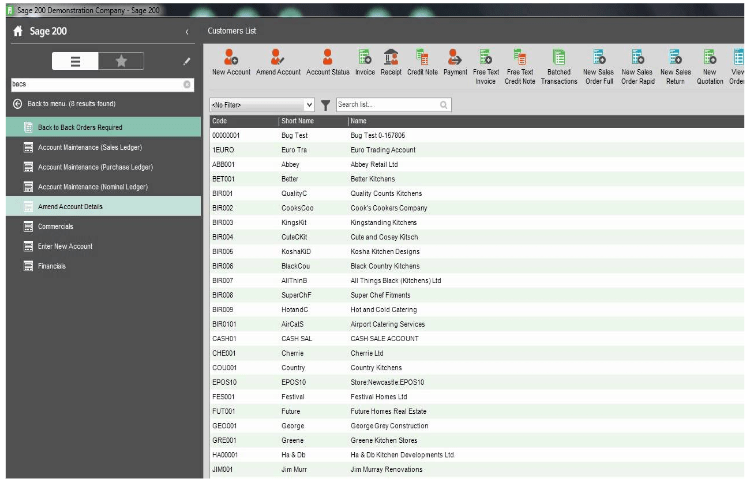

Sage

Sage’s focus on compliance and reporting makes it a suitable choice for businesses operating in regulated industries. It has a range of solutions for small to large size businesses, making it a worthy contender. Sage has reliable cash flow management features, often integrated with its accounting software. It is a familiar and reliable option for many UK business owners. Sage’s other features include budgeting, reporting, and bank reconciliation.

Cons:

- Less flexible than cloud software

- Some of its features are hard to learn

FreeAgent

If you are looking for cloud-based accounting software designed specifically for freelancers and sole traders, FreeAgent is the right option. It comes with income and expense tracking, invoicing, bank reconciliation, cash flow forecasting, and tax calculations. FreeAgent’s affordability and ease of use make it an excellent entry point for those new to financial management software. Its integration with many UK banks further streamlines financial administration.

Cons:

- Limited features compared to comprehensive solutions

- Not ideal for scaling businesses

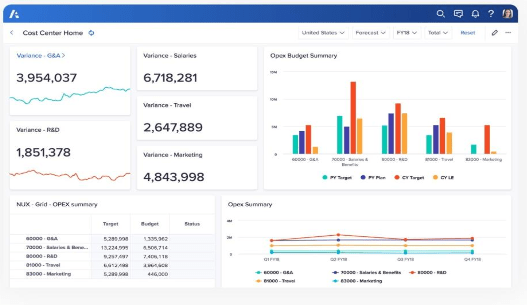

Anaplan

Anaplan secures a top spot among cash flow management solutions due to its powerful financial planning and forecasting capabilities. Designed for large enterprises, it offers real-time modeling, scenario planning, and predictive analytics to help businesses optimise cash flow and budgeting. Anaplan’s cloud-based platform integrates seamlessly with other enterprise systems, providing deep insights into financial performance. Its flexibility makes it an excellent choice for companies needing complex financial modeling beyond basic accounting software.

Cons:

- Difficult to operate for new users

- High cost, making it less ideal for small businesses

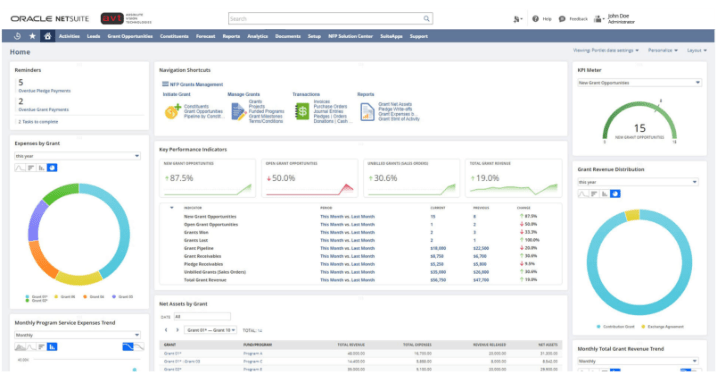

NetSuite

NetSuite by Oracle is a comprehensive ERP solution that includes robust cash flow management, financial reporting, and automation tools. It streamlines accounting, accounts payable/receivable, and expense tracking whilst offering real-time dashboards for financial insights. With its cloud-based infrastructure, NetSuite allows businesses to scale efficiently and integrate various functions, from inventory to customer relationship management. This makes it a preferred choice for mid-sized and large enterprises looking for an all-in-one financial management system.

Cons:

- Expensive and requires professional setup

- Can be complex for smaller businesses with basic needs

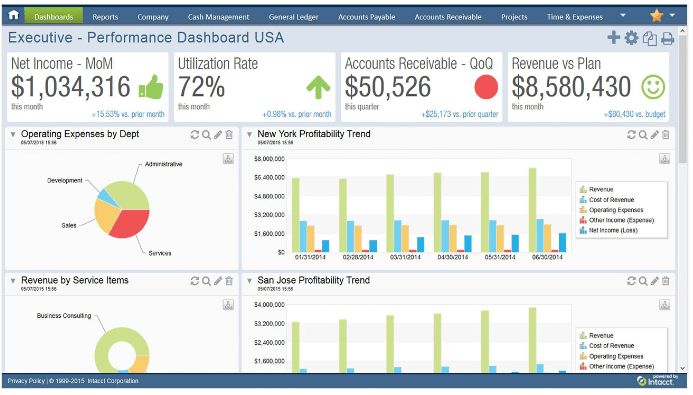

Sage Intacct

Sage Intacct is a leading cloud-based financial management system tailored for growing businesses. It excels in cash flow forecasting, budgeting, and automation, helping companies manage accounts payable, receivables, and subscription-based billing with ease. Its intuitive interface and strong reporting features make it a favorite among CFOs and finance teams. Additionally, Sage Intacct offers AI-powered analytics and deep integration with other business applications, making it a strategic tool for businesses looking to improve financial decision-making.

Cons:

- Higher learning curve compared to entry-level accounting software

- Premium pricing for advanced features

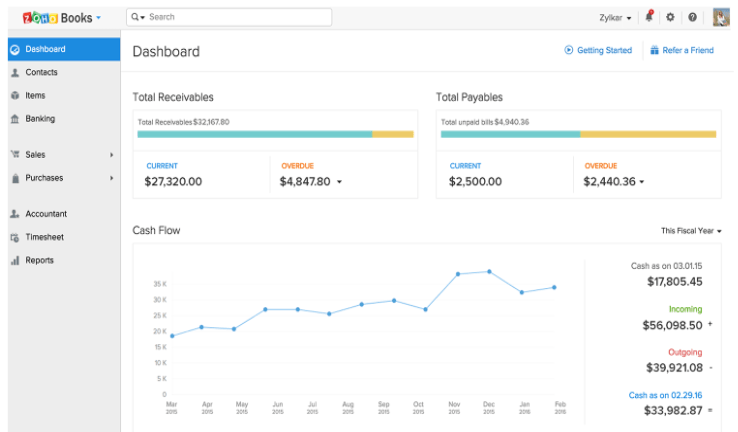

Zoho Books

Zoho provides an affordable and user-friendly financial management solution for startups and small businesses. It includes invoicing, expense tracking, budgeting, and cash flow forecasting, all within a user-friendly cloud-based interface. Zoho’s automation tools simplify financial workflows, whilst its integration with CRM and other Zoho apps enhances overall business management. Its cost-effectiveness makes it an attractive choice for businesses looking for a budget-friendly alternative to larger ERP systems.

Cons:

- Lacks some advanced financial planning features

- Limited scalability for large enterprises

Using the Right Tools

Managing cash flow is all about making sense of your finances and staying ahead of potential shortfalls. The right cash flow software can give you clarity, automate tedious tasks, and help you make smarter decisions.

When it comes to efficient cash flow management, there are three types of tools to consider:

Accounting Software

The best accounting software keeps track of income, expenses, and overall financial health. They automate bookkeeping, generate reports, and make tax season a whole lot easier. With built-in cash flow mapper tools, they help businesses visualise and track cash movements in real time, ensuring enough liquidity to cover expenses.

A small business with simple transactions may need basic financial projection software, whilst a fast-growing company might require advanced features for forecasting and automation.

Cash Flow Planners

The purpose of cash flow planners is to help you predict where your cash flow is headed. Platforms like Anaplan cash flow tool on excel analyse past trends, real-time data, and projected expenses to create accurate cash flow forecasts, so you’re never caught off guard.

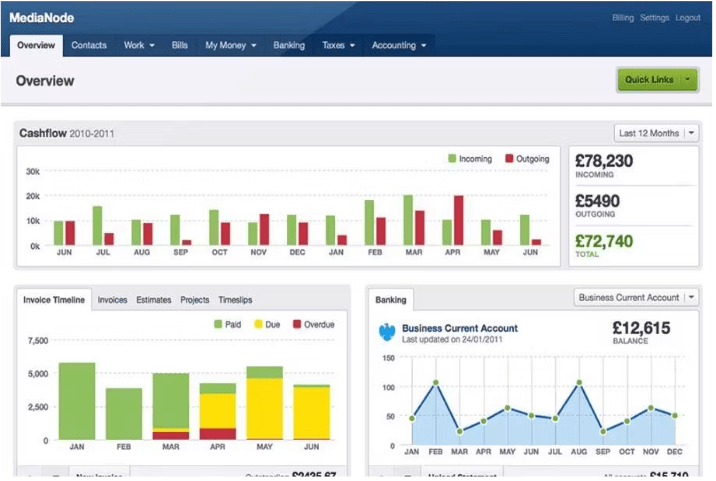

Dashboards

A good financial dashboard gives you a real-time snapshot of your cash flow, helping you spot trends and potential issues before they become major problems. With clear visuals and instant insights, you can make quick, informed decisions.

Tips for Effective Cash Flow Management

Whilst software can streamline cash flow management, adopting smart financial habits is equally important. By combining best practices with reliable cash flow management software, businesses can maintain financial stability and avoid liquidity issues.

Here are some practical tips to ensure a healthy cash flow for your business:

Regularly Review Finances

Keep a close eye on your income, expenses, and financial statements. Regular financial checkups help identify potential cash shortages before they become a problem.

Invoice Promptly

Late payments can disrupt cash flow. Send invoices immediately after completing a job or delivering goods and use automated reminders to send timely payments.

Manage Expenses Wisely

Avoid unnecessary spending and look for cost-saving opportunities. Track recurring expenses and negotiate better deals with vendors to improve cash retention.

Build Strong Supplier Relationships

Good relationships with suppliers can lead to better payment terms, discounts, and flexibility during financial downturns. Open communication and trust can help smooth cash flow fluctuations.

Frequently Asked Questions

Is cloud-based software secure?

Trust a provider with a proven track record. Reputable cloud-based software providers invest heavily in security measures than those available to individual businesses. Data encryption, access controls, and regular security audits are standard practices.

Which software integrates with Xero?

Float, Futrli, Pulse, Caura all integrate with Xero. You can also verify compatibility directly with the software provider before making a purchase.

What is SaaS, and how does it relate to cash flow management software?

Software as a Service (SaaS) is a delivery model where software is hosted by a provider and accessed over the internet. Most modern cash flow management software is SaaS, offering benefits like accessibility, automatic updates, and often more flexible pricing.

How much does cash flow management software cost?

Most modern cash flow management software is subscription-based, providing monthly and annual subscriptions. But free trials are also available. Xero, Basic QuickBooks, and FreeAgent cost between £10 to £50 per month whilst more advanced versions cost between £50 to over £200.

Take Control of Your Cash Flow with Legend Financial

Effective cashflow management is how you stay competitive in the business industry. Doing it properly helps you to allocate resources where they are needed most, seize new opportunities, and weather unexpected challenges. By using our recommended cash flow management software, you are not just managing your finances but positioning your business for long-term success.

Take control of your business’ future with Legend Financial. Reach out to us today!